TSA Pay Scale

Learn about the TSA payment system, the different salaries and pay scales for various positions and levels.

Master airport security with ease! Prepare confidently with our TSA Practice Test and Test Prep materials to ensure you're ready for anything TSA throws your way. Start practicing today and fly through your test with flying colors!

Past and Present: The TSA SV Grading System

Unlike most federal agencies, the TSA did not originally use the General Schedule (GS) pay system to determine salary ranges. Instead, it employed an agency-specific pay system called the TSA Pay Band system. However, starting from the summer of 2023, the TSA's Pay Equity Plan has updated the TSA Pay Band system to match the GS system, making it equivalent to the GS grades between 5 and 15. TSA pay bands are identified by the letters D-L, with each band having a minimum and maximum rate. Employees can be hired at a rate higher than the minimum if they have relevant job experience. Rates also vary across the country, resulting in different salaries based on locality pay, similar to the GS scale.

For example, the base salary for a full-time D-band position ranges from $32,357 to $45,155. In Alaska, where the locality pay is 31.96%, D-band salaries range from approximately $44,705 to $58,114.

What Is the General Schedule (GS)?

The GS is the dominant pay scale for federal civilian employees, awarded to over 70% of them. It consists of 15 grades, from GS-1 to GS-15. Each grade is divided into 10 levels. The grade level assigned to a position determines the salary for a specific position.

How to become a TSA agent? Read on TSO Hiring Process and TSA CBT and TAB Tests.

TSA Base Pay Band Ranges for 2024

The following table describes the different Pay Band ranges (between B and L), with minimum and maximum wages, as well as the GS equivalents.

| Pay Band | Minimum (Step 1) | Maximum (Step 10) | GS Equivalent |

|---|---|---|---|

| B | $28,606 | $34,510 | |

| C | $29,178 | $39,285 | |

| D | $32,357 | $45,155 | GS-05 |

| E | $40,082 | $52,106 | GS-07 |

| F | $49,028 | $63,743 | GS-09 |

| G | $59,319 | $77,112 | GS-11 |

| H | $71,099 | $92,438 | GS-12 |

| I | $84,546 | $109,908 | GS-13 |

| J | $99,908 | $130,481 | GS-14 |

| K | $117,518 | $154,445 | GS-15 |

| L | $120,273 | $181,716 | GS-15 |

Matches minimum compensation levels with the General Schedule (GS).

Pay Bands Range by Job

The following table details the Pay Bands according to the different positions that exist within TSA.

| TSA Job | Pay Band Range | Minimum Starting Salary | Maximum Salary |

|---|---|---|---|

| Transportation Security Officer (TSO) | D – E | $32,357 | $52,106 |

| Transportation Security Manager (TSM) | H – I | $71,099 | $109,908 |

| Clerical Support | C – E | $29,178 | $52,106 |

| Administrative Support | D – F | $32,357 | $63,743 |

| Technical Support | E – G | $40,082 | $77,112 |

| Para-Professional | F – H | $49,028 | $92,438 |

| Professional | F – L | $49,028 | $181,716 |

| Technical | G – L | $59,319 | $181,716 |

| Engineering | G – L | $59,319 | $181,716 |

| Engineering Technical (0802) Electronics Technical (0856) Transportation Specialist (2101) | F – J | $49,028 | $130,481 |

| General Attorney (0905) | G – L | $59,319 | $181,716 |

| Medical Officer (0602) | G – L | $59,319 | $181,716 |

| Compliance Inspection And Support (1802) | C – G | $29,178 | $77,112 |

| Coordination Center Officer (0086) | F – G | $49,028 | $77,112 |

Locality Pays for 2024

The following table describes the different Locality Pays. This system is independent of the different grading systems and corresponds to both SV and GS. The percentages describe the wage increases added to the wages in the Pay Band Ranges table according to locality.

| Main Area | Code | Pay Adjustments |

|---|---|---|

| Alaska | ALASKA | 31.96% |

| Albany | ALBANY | 20.25% |

| Albuquerque | ALBUQUERQUE | 18.05% |

| Atlanta | ATLANTA | 23.45% |

| Austin | AUSTIN | 19.99% |

| Birmingham | BIRMINGHAM | 17.91% |

| Boston | BOSTON | 31.97% |

| Buffalo | BUFFALO | 21.99% |

| Burlington | BURLINGTON | 18.97% |

| Charlotte | CHARLOTTE | 19.26% |

| Chicago | CHICAGO | 30.41% |

| Cincinnati | CINCINNATI | 21.69% |

| Cleveland | CLEVELAND | 22.01% |

| Colorado Springs | COLORADO | 19.73% |

| Columbus | COLUMBUS | 20.35% |

| Corpus Christi | CORPUS | 17.94% |

| Dallas | DALLAS | 24.98% |

| Davenport | DAVENPORT | 17.21% |

| Dayton | DAYTON | 19.13% |

| Denver | DENVER | 26.32% |

| Des Moines | DESMOINES | 17.08% |

| Detroit | DETROIT | 26.56% |

| Harrisburg | HARRISBURG | 17.20% |

| Hartford | HARTFORD | 31.02% |

| Hawaii | HAWAII | 19.56% |

| Houston | HOUSTON | 33.32% |

| Huntsville | HUNTSVILLE | 19.85% |

| Indianapolis | INDIANAPOLIS | 17.02% |

| Kansas City | KANSASCITY | 17.13% |

| Laredo | LAREDO | 18.88% |

| Las Vegas | LASVEGAS | 17.68% |

| Los Angeles | LOSANGELES | 32.41% |

| Miami | MIAMI | 23.51% |

| Milwaukee | MILWAUKEE | 20.96% |

| Minneapolis | MINNEAPOLIS | 24.66% |

| New York City | NEWYORKCITY | 33.98% |

| Omaha | OMAHA | 16.33% |

| Palm Bay | PALMBAY | 16.73% |

| Philadelphia | PHILADELPHIA | 26.04% |

| Phoenix | PHOENIX | 20.12% |

| Pittsburgh | PITTSBURGH | 20.78% |

| Portland | PORTLAND | 22.17% |

| Raleigh | RALEIGH | 20.49% |

| Richmond | RICHMOND | 19.95% |

| Sacramento | SACRAMENTO | 26.37% |

| San Antonio | SANANTONIO | 16.77% |

| San Diego | SANDIEGO | 29.77% |

| San Francisco | SANFRANCISCO | 41.44% |

| Seattle | SEATTLE | 27.02% |

| St. Louis | STLOUIS | 17.65% |

| Tucson | TUCSON | 17.19% |

| Virginia Beach | VIRGINIABEACH | 16.51% |

| Washington DC | WASHINGTONDC | 30.48% |

| Rest of United States | RESTOFUS | 16.82% |

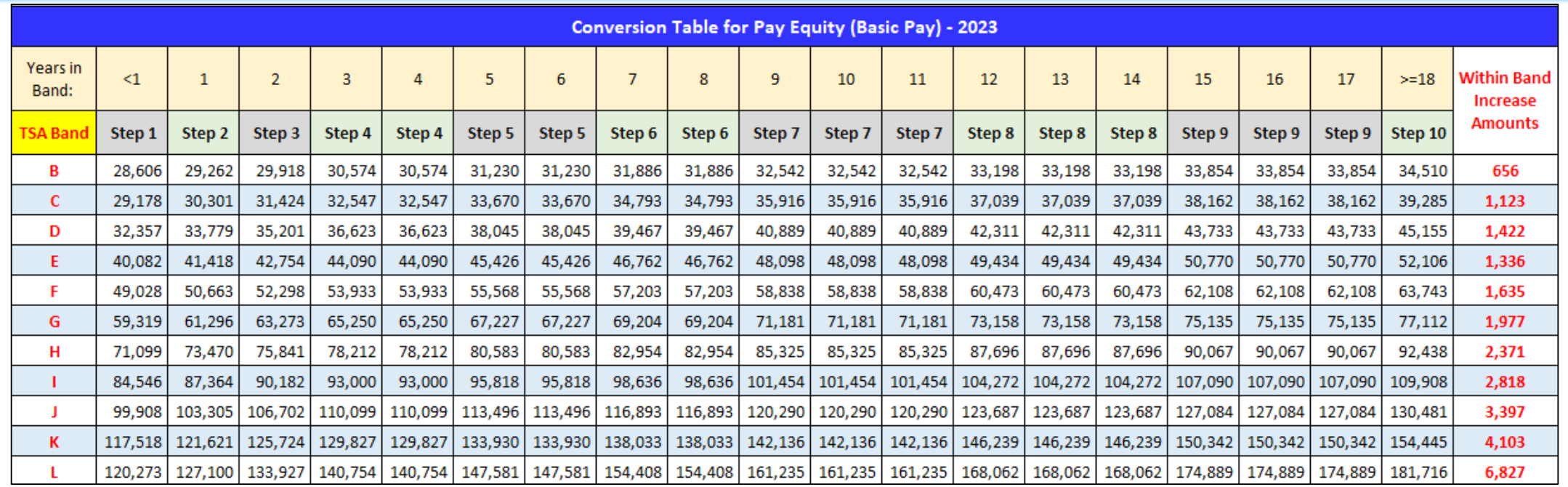

TSA Conversion Table for Pay Equity (Basic Pay) for 2023

Levels and Conversion

The TSA Pay Band system comprises 10 levels within each band, with specific durations of creditable service required to advance to the next level. The progression periods align with the General Schedule (GS) system:

- From Step 1 to Step 2: 52 weeks of creditable service in Step 1

- From Step 2 to Step 3: 52 weeks of creditable service in Step 2

- From Step 3 to Step 4: 52 weeks of creditable service in Step 3

- From Step 4 to Step 5: 104 weeks of creditable service in Step 4

- From Step 5 to Step 6: 104 weeks of creditable service in Step 5

- From Step 6 to Step 7: 104 weeks of creditable service in Step 6

- From Step 7 to Step 8: 156 weeks of creditable service in Step 7

- From Step 8 to Step 9: 156 weeks of creditable service in Step 8

- From Step 9 to Step 10: 156 weeks of creditable service in Step 9

How Does the Conversion System Work?

The majority of employees will see their pay adjusted based on either their current time-in-band or their current base pay. If an employee's current base pay is higher than what it would be based on time-in-band, their pay will be set at the closest higher step in their pay band.

For example, if an employee, like David, has been an I band Transportation Security Officer (TSO) since 2013 with a base pay of $72,353, they would be converted to an I band Step 7, resulting in a new base salary of $101,454.

For employees like Laura, a G band Program Analyst hired in 2020 with a base pay of $66,120, the conversion would typically place her at G band Step 4 with a base salary of $65,250. However, because her current pay exceeds this amount, she would be adjusted to G band Step 5, with a new base salary of $67,227.

Conversion Process for LTSOs and MTSO-STI

Employees in roles such as Lead Transportation Security Officers (LTSOs) and Master Transportation Security Officers - Security Training Instructors (MTSO-STIs) will generally follow the time-in-band conversion and receive an additional step increase. For instance, Alice, promoted to LTSO in 2016 with a base salary of $42,337, will be credited with eight years of time-in-band, moving her to F band Step 6. She will then receive an additional step increase to F band Step 7, resulting in a base salary of $58,838. In most cases, LTSOs and MTSO-STIs will be converted using the current time-in-band approach and then receive one additional step increase. Alice is first converted based on her current time-in-band and is set to F band Step 6. She then receives a one-step increase which applies to LTSOs and MTSO-STI, setting her base pay to F band Step 7 with a base salary of $58,838.

Breaks in Service and Recent Promotions

Employees who have had breaks in their TSA service will have all their previous TSA time credited when they return. For example, if an employee was a G band from 2012-2016, left TSA, and was rehired in 2021, they would accumulate a total of five years of time-in-band credit.

For recent promotions within the last three years, TSA will use either the current time-in-band or the cumulative time in the previous band before promotion, whichever is more beneficial.

Consider Mark, who served as a J band Program Analyst for five years before leaving TSA and was rehired in 2022. If his conversion was based solely on his current time-in-band, he would be placed at J band Step 2 with an annual salary of $106,702. However, using the cumulative time-in-band approach, Mark's total of six years would place him at J band Step 5, with a new base pay of $113,496.

Similarly, for employees like Karen, promoted to a higher band within the last three years, TSA will use either her current or cumulative time-in-band, depending on which is higher. If Karen, who was promoted to a J band after 14 years in an I band, her pay would be adjusted to the step in the J band that is equal to or higher than her previous pay.

Handling Demotions

In cases of involuntary workforce reductions (IWR) or procedures for workforce adjustments (PWA), employees will receive cumulative time-in-band credit as if the demotion never occurred. For instance, Emily, who was demoted from H band to G band due to a PWA action but later promoted back to H band, would have her cumulative time credited, placing her at H band Step 6 with a new base pay of $82,954.

For voluntary demotions unrelated to performance or conduct, employees will receive time-in-band credit for both the current and higher bands. For example, John, who voluntarily downgraded from H band to F band for personal reasons, would accumulate a total of 19 years of time-in-band, placing him at F band Step 10 with a base salary of $63,743.

Additional Information and FAQs

For retirement and benefits purposes, TSA follows Title 5 guidelines. The high-three average salary calculation for retirement remains unchanged, including all salary increases for which retirement deductions are withheld. This calculation uses the highest average of annual basic pay over any consecutive three-year period, typically the last three years of service.

Employees can request one retirement estimate per year, provided they are within two years of retirement eligibility.